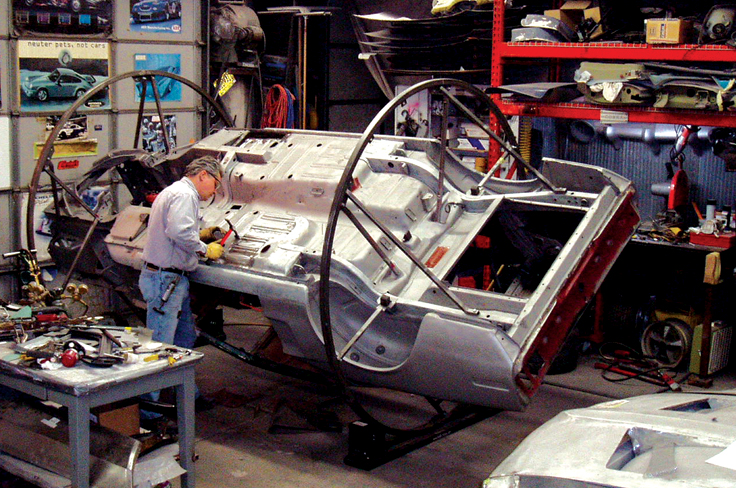

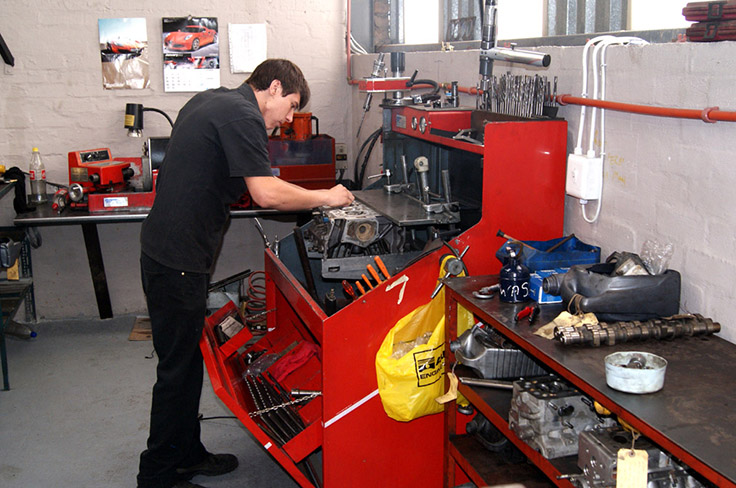

Insurance as finely crafted as your restorations.

Coverage Highlights:

Insurance For America’s Restoration Shops

The insurance experts at Grundy can cost effectively cover your liability for both accidents and/or losses caused by damage you cause during the restoration process. We cover restorations in progress on an Agreed Value basis under our Garage Keeper’s policy. We also insure your business’s building, its contents, plus your tools and equipment on the premises with “All Risk” property policies.

An extremely important feature of our insurance is that our direct primary coverage policies protect you when being held liable or subrogated by insurers of your customers’ vehicles while in your care.

Grundy Agreed Value Shop Coverage includes:

- Garage Keeper’s Coverage – Covers physical damage to your customers’ cars on an Agreed Value basis. Once the underwriting team has agreed to the values of the cars under your care, those values become the coverage limits but can be increased at any time during the restoration. If there is a total loss, the agreed value of the vehicle is paid. Auto liability limits of up to $1,000,000 are available. This coverage includes comprehensive and collision on automobiles being restored as well as vehicles under construction.

Grundy “All Risk” Replacement Cost Coverage includes:

- Building and Contents – Your building and its contents including raw materials, office furniture, communications equipment, computers, and other implements used to do business are covered at their replacement cost.

Grundy Liability Coverage includes:

- General Liability Coverage – If a customer or a visitor is injured as a result of an accident that occurs in your garage, you are covered if you are responsible for the injuries.

- Auto Liability Coverage – Not only are your businesses’ vehicles covered, but your customers’ cars are. Grundy insures your owned vehicles used in your business, dealer tags if you have them, and our liability extends to customer cars during test drives.

Call Us

+1 (866) 338-4006

Fax Us

+ 1 (267) 966-2246

Message Us